Steps to Buy a Second Home in Big Bear Lake

Steps to Buy a Second Home in Big Bear Lake

Buying a second home in Big Bear Lake is an excellent way to enjoy the mountain lifestyle, create potential rental income, and build lasting value amid strong local demand and rising property prices.

Assess Your Goals and Budget

Start by defining your main objective for the home—vacation retreat, investment, or future retirement spot. Budget carefully, accounting for local median home prices (about $585,000 to $738,000), a minimum 10% down payment, and 2%-4% for closing costs. Mortgage lenders typically ask for a credit score of 680 or higher for second-home financing.

Secure Financing and Pre-Approval

Most buyers use conventional loans, with stricter qualification rules than for a primary residence. Prepare your financial paperwork, understand the debt-to-income requirements (maximum 45%), and ensure your intended use matches “second home” definitions—frequent personal use is key, even if occasional rentals are planned.

Partner with Bradford King and the Bradford King Group—Your Local Big Bear Agent

Expert local knowledge is invaluable in Big Bear Lake’s dynamic market, and Bradford King is one of the area’s top-ranking realtors. With hundreds of homes sold and a stellar reputation for service, Bradford King brings unmatched insight into Big Bear Lake neighborhoods, waterfront cabins, HOA rules, and vacation rental regulations.

Working with Bradford King means:

-

Tailored guidance on all home types and locations.

-

Negotiation strategies proven in hundreds of local transactions.

-

Insider tips on the region’s best deals and hidden gems.

-

Trusted referrals for inspections, insurance, utilities, and more.

Buyers continually praise Bradford for market expertise, responsiveness, and commitment—from first showing to closing, you have a dedicated advocate ensuring your second home purchase is smooth, informed, and rewarding.

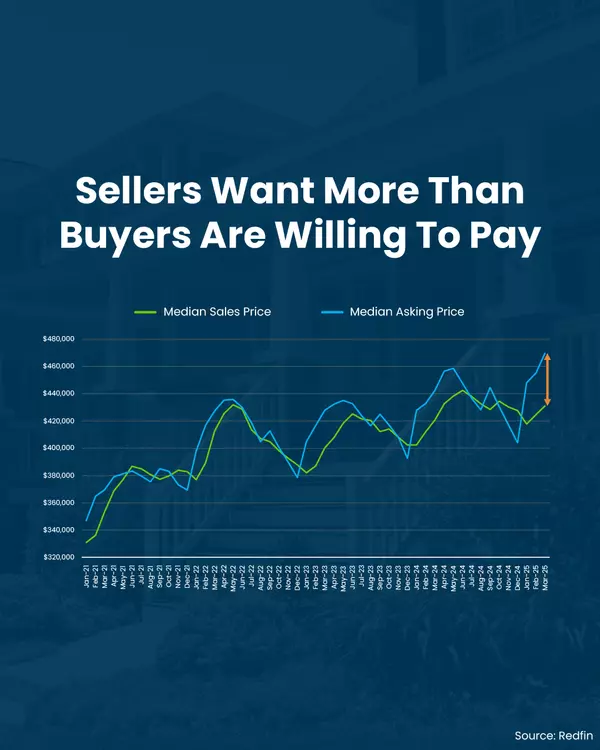

Make a Competitive Offer

With your agent’s help, structure a strong offer based on current prices and trends—expect properties to sell near or slightly below asking price. An earnest money deposit of 1%-3% is standard, and the California Residential Purchase Agreement is commonly used.

Complete Due Diligence

Work with inspectors and legal professionals to complete physical and document checks, especially in HOA communities or properties near the lake. Pay close attention to required disclosures (natural hazards, fire risk), local ordinances, and rental restrictions.

Verify Insurance and Utilities

Mountain homes may have higher or less predictable insurance rates, so check coverage options early. Understand utility costs for heating, water, and snow removal—remote cabins can incur extra expenses.

Finalize and Close

Closing with a mortgage typically takes 21-45 days; cash deals may close sooner. Budget 2%-4% for closing costs, including lender fees, escrow, and title insurance.

-

Bring proof of homeowners insurance.

-

Transfer funds for closing costs and down payment.

-

Review all final paperwork in detail with your agent.

Why Work with Bradford King?

Bradford King’s local expertise and hands-on support ensure your goals are met and your investment is protected. Whether searching for a cozy cabin or dream lakefront home, Bradford King is your Big Bear Lake specialist—ready to help you achieve an exceptional result.

Connect today with Bradford King and make your second home aspirations a reality in Big Bear Lake—backed by the region’s leading real estate advocate!

Categories

Recent Posts